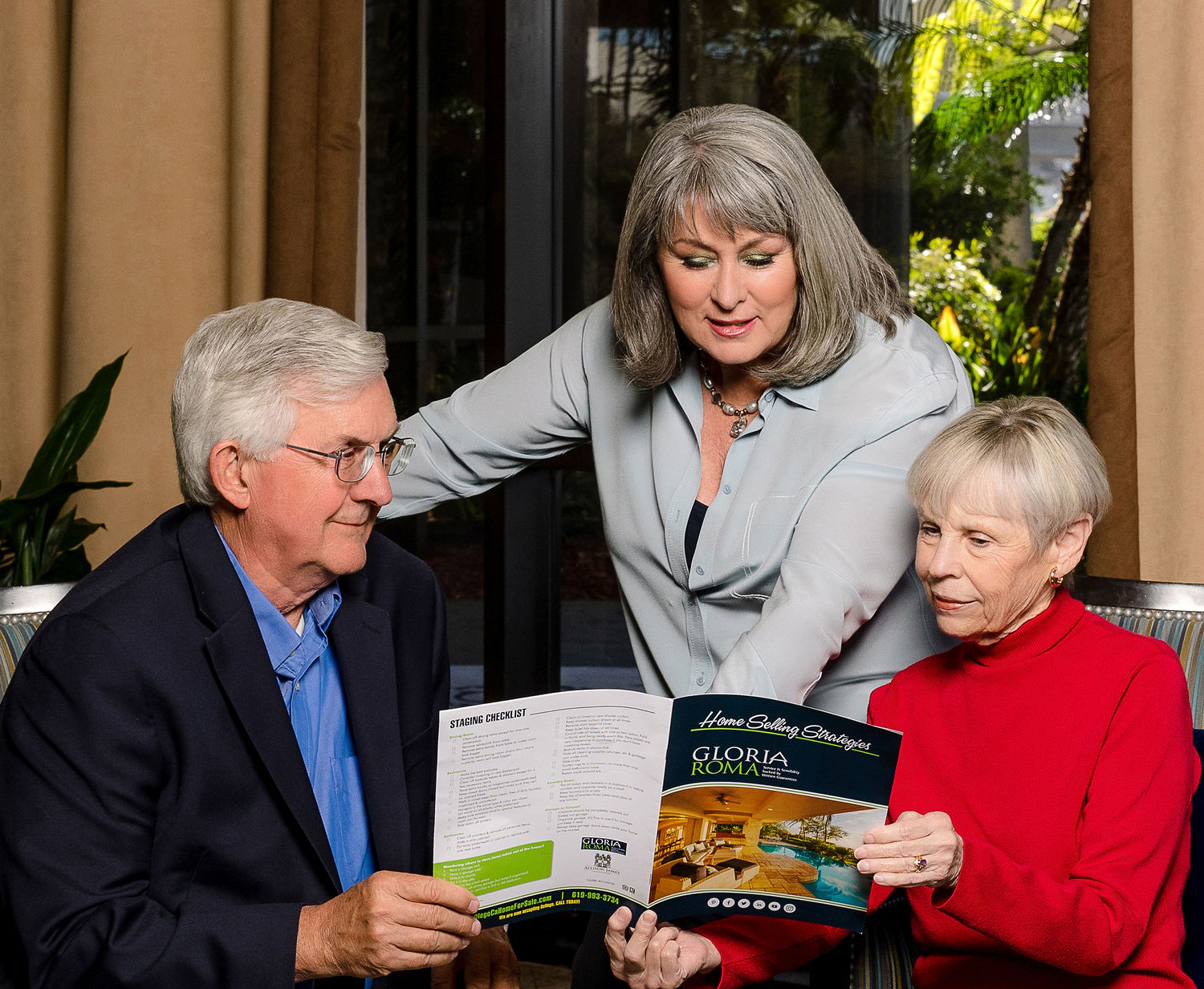

Real Estate Trusts: Pros & Cons Real estate trusts work hard for you because you’ve worked hard, bought a nice home and built up some equity in it. You are getting up in age and are considering placing the home into a real estate trust. You’ve heard that a real estate trust is the way […]